using data from the Bureau of Labor Statistics

Success isn’t always about greatness. It’s about consistency. Consistent hard work leads to success. Greatness will come.

–Dwayne Johnson

You have done it! Gone out on a limb and started your own small business. You have taken something you love and are good at and started a small business. That is not an easy task; it takes hard work, determination, and perseverance. Give yourself a pat on the back and a round of applause!

Whether you are an artist, a retailer, a dog walker, a startup tech company, or a baker, chances are your background is not in finance, accounting, or bookkeeping. As a small business owner, I am sure you have quickly realized that it doesn’t mean you don’t have to deal with the books.

The Difficulties

Let’s talk about the hard stuff for a moment. Being a small business owner is not for the faint of heart. It can be scary; we all have heard the statistics! According to this article from B2B Reviews using data from the Bureau of Labor Statistics, 21% of companies fail by their first year, 28% fail by their second year, 48% by their fifth year, and 65% fail by their tenth year. Finally, 70% of small business owners fail in their 10th year in business. OUCH. Those numbers are hard to swallow, right? If we learn and understand the reasons why so many fail, we can work to avoid those pitfalls.

While there are several reasons, the first and foremost is money. A significant factor in business success or failure lies in finances and financial planning. Let’s talk about how to set you and your business up for success, and together let’ s bet those odds!

You probably already have found accounting software and are using it. The most popular option is QuickBooks, but there are other up and coming options out there. QuickBooks can do a fantastic job of organizing your data and finances, but many find it can be a little overwhelming. There are a few places QB falls short, and those are the areas where Reach Reporting, a financial reporting software comes into play.

The Answer

I am sure you are asking, “If I have quick books, why do I need additional reporting software” Well, I am so glad you asked! Let’s dive right in and answer your question.

Your area of expertise is not in bookkeeping, accounting, or finance—that’s why you are a small business owner and not a CPA. So most likely, the information QB is giving you is not in a language you understand or have time to learn to understand. This is where Reach Reporting comes in to save the day!

Quick books can do the calculating and organizing of the information. It can do payroll and invoices, accounts payable and receivable, and bank reconciliation, but what it cannot do is translate the accounting/financial jargon into information that is understandable for someone outside the accounting world. It shouldn’t be so hard to understand your finances. You can be entirely up to date inside QB, but if you don’t understand the information QB spits out, it is useless. All the financials in the world mean nothing if they are not understandable by the one person who needs to understand them, YOU!

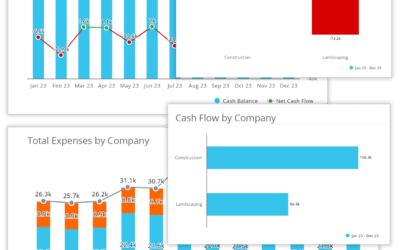

Enter Reach Reporting to change the situation. Once you have completed your initial setup and are logged in to Reach Reporting, your data is pulled directly from QuickBooks and is always up to date with the most current information. Now that your information is in Reach, it is translated into understandable visual data for you, the small business owner. Reach has three areas within its software to help you wholly and understand your business’ finances.

Dashboard

The dashboard is the first place you land once in our software. It is filled with charts and graphs that show your KPI’s (Key Performance Indicators). For example, debt to equity, bank balance history, total income, and many many more. The dashboard is completely customizable; you choose the KPI’s you want to see. The dashboard is the ideal place to see the overall financial health of your company. You get a wide-scale glance at lots of information but can also drill down and see details to understand why. The dashboard is the first place you can see a small problem before it becomes a big problem. Even better, is it a place to know where you are succeeding and reaching your goals! This is your “Home Page” within Reach.

Spread Sheets

You can pull data into Reach from sources other than QuickBooks. Any Excel or Google Sheets data you have already created can be easily imported into Reach then translated into visual data. Charts and graphs are immensely more natural to understand than the standard spreadsheet, making the data more useful to you and your business. The most helpful part is the data in Reach spreadsheets is LIVE data, with no outdated information. You can also create KPI’s directly from your spreadsheet. Then they can easily be added to your dashboard, so the information is easy to read and easy to find.

Report Generation

Yes, QuickBooks can create reports, but if we are honest, they most definitely leave something to be desired. In other words, they are not very user-friendly or easy to create or understand. In Reach reporting, you can have a beautiful report that is clear and concise in minutes! Yes, you read that correctly, minutes! These reports take financial data and turn it into visual information. These reports are fully customizable, add in as much or as little information as you would like. Once you have created a report, save it in the “My Library” section, and it is ready for the next month or quarter, which saves time each time a report is created.

These reports are useful for yourself as the business owner. They are also great for showing current investors or future investors your financial health, and even an easy way to organize your information when it is time to apply for an SBA loan. We have a whole blog post just on applying for SBA loans, so head there for more details.

Head on over to Reach Reporting, and let’s get you understanding and loving the finances of your business. We genuinely want to help you not be one of the statistics of a failed business but be a HUGE success! We are here to answer your questions and translate your finances so you can make your business decisions with a full understanding of your finances.

0 Comments