Have you ever found yourself in a meeting with your accountant or financial advisor and realized that you have no idea what they’re talking about? You’re not alone. In fact, a study by Wasp Barcode found that 21% of small business owners don’t have even a general knowledge of accounting and finance.

While it can be tempting to stay quiet and pretend that you understand, doing so can have serious consequences for your business. That’s why it’s essential to increase your financial literacy and communicate effectively with your accountant. Here’s how to get started.

Increase Your Knowledge

One of the best ways to increase your financial literacy is to familiarize yourself with common accounting terms and concepts. Start with basic terms like “accounts payable” and “accounts receivable,” and work your way up to more advanced concepts like “cost of goods sold” and “GAAP.” Websites like American Express, QuickBooks, and PaySimple offer helpful lists of accounting terms to get you started.

Ask Questions

Never be afraid to ask your accountant questions. They’re there to help you understand and make informed financial decisions. Come prepared with a list of questions you have, such as “What records should I be keeping?” or “How can I better manage my cash flow?” Asking the right questions will help you make intelligent financial decisions for your business.

Share Your Company Goals

It’s important to let your accountant know what your financial goals are for your business. Work together to set achievable goals and check back regularly to see how you’re progressing. When you’re both on the same page, the sky is the limit.

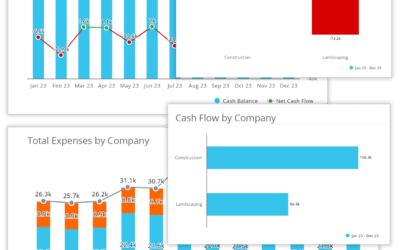

Make Sure Your Accountant Uses Reach Reporting

Reach Reporting can help increase your financial literacy and communicate effectively with your accountant. With visually stunning reports, interactive dashboards, and budgeting and forecasting tools, Reach Reporting makes it easy to understand your financial data and make informed decisions for your business. Plus, it saves you time by reducing the time you put into reporting and budgeting, allowing you to focus on growing your business and making more money.

Don’t be afraid to say “I don’t understand.” Financial literacy is critical to the success of your business, and your accountant is there to help you make informed decisions. Use the tips above to increase your financial literacy, communicate effectively with your accountant, and make sure they are using Reach Reporting to make the process even easier.

Excellent article and advice!

Thanks for the info! These tips are practical and great starting points for new and seasoned business owners.

Great article, Laura. I will definitely be asking many of these questions. Thank you for the advice.

Nice blog! Very interesting reading.

Awesome info! Very well written!

Great article. Well written with practical advice given. Don’t be afraid to tell people you don’t understand.

Just 2 small things

Banc Reconciliation (bank misspelled. Unless you wanted it that way)

What records should I be keeping? (this is the only question italicized. Is that because it is the most important question to ask?)

I know my accountant has been invaluable to me. Thank you for the suggestion of things I can ask to better utilize his expertise!

Wow! Great blog Laura. Knowledge is very often power. And knowledge of one’s business can drive value.

I agree that getting to know these basic terms has helped me understand conversations so much better! Good info!